What is rent-to-own?

What is the 360° Rent-to-own program with Sia Management?

The added value of the program is achieved through ongoing support which not only covers homeownership access, but also where assistance is provided to establish and maintain sound financial management. Indeed, with the collaboration of mortgage brokers and financial advisors, we focus on improving our clients’ credit, helping them save for the down payment needed to buy the house of their dreams, and to plan and manage their budget.

Who can qualify to the program?

Anyone with a steady family income of a minimum of $ 65,000. This amount is subject to change depending on the desired property. The program targets people in one of the following situations:

- Bad credit and/or insufficient down payment

- Self-employed individual or new immigrants

- Discharged from a bankruptcy or consumer proposal

- 60-day Notice

- Inability to refinance the mortgage

- High mortgage payments (1st or 2nd rank with Private lender)

Is there a security deposit required?

Yes, without exception! The minimum deposit is 5% of the value of the desired property. Depending on the clients’ financial situation and other factors related to the house, we can adjust the requested minimum deposit. The deposit will be deducted from the down payment when the tenant-buyers will purchase the house.

What are the terms?

A rent-to-own option has a term of 1 to 3 years, giving the time to improve the credit score and/or to raise enough funds for the down payment.

Some obligations of tenant-buyers

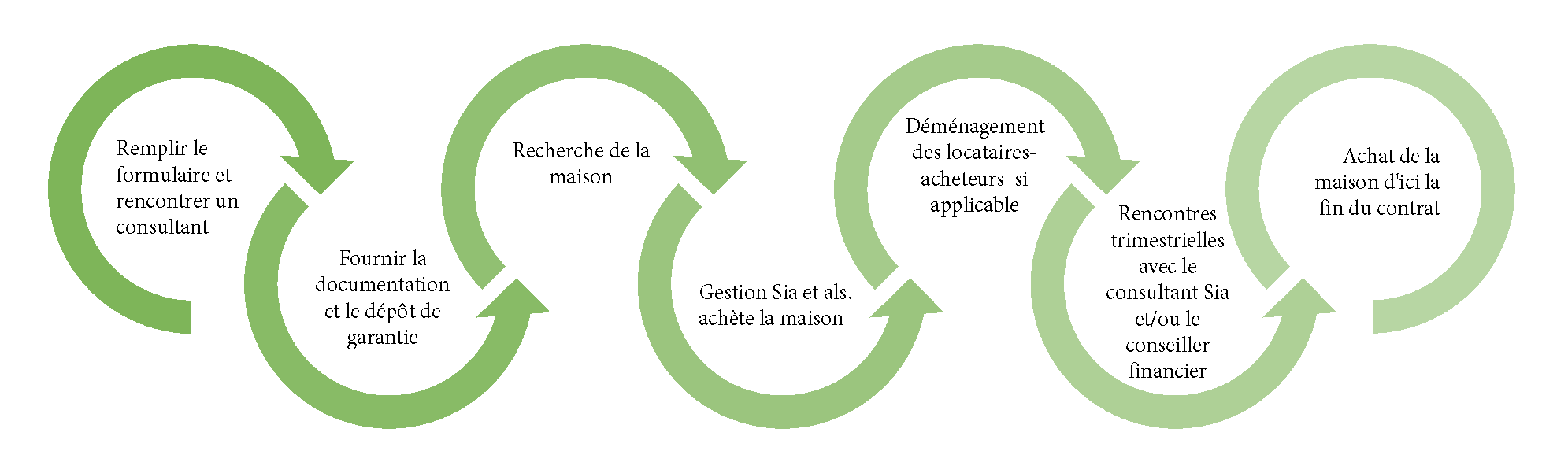

Prior to Gestion Sia purchasing the house, future tenant-buyers must submit the necessary documents to verify their current financial situation and their history. Inspection and modernization costs are borne by clients. Any damage caused by the tenant-buyers and any necessary repair due to the choice of the property made by clients is their responsibility.

How does Sia Management help its clients restoring their credit and increase their down payment?

Tenant-buyers will meet with one of our consultants at the beginning of the process to determine the requirements to meet, in order to buy the house. Clients will also have to attend meetings to follow up on their file and adjust the plan if needed.

How much the property will be sold for?

The amount is known before the signature of contracts and will not exceed the tenant-buyers’ capacity of payment of which is based on their family income. In addition, a study on the sector will be carried out to determine the selling price.

Français

Français